Bull market strategies wisely invest in cryptocurrency growing

The cryptocurrency world has experienced a significant increase in popularity over the last decade, with many investors flowing to this new market as a potential source of high return. However, despite the promise of astronomical benefits, investing in cryptocurrency growing fruiting can be highly volatile and before diving. This article should be carefully considered. In this article, we will explore some effective bull market strategies to reasonably invest in the growing cryptocurrency.

Understanding of fluctuations in cryptocurrency market

Cryptocurrencies are digital or virtual currencies that operate independently of traditional financial systems. They use cryptography to provide and test transactions to create a decentralized network resistant to government or central bank censorship and control.

As with any active class, cryptocurrency prices may be subject to significant fluctuations over time. During rapid growth periods, such as bull markets, the value of cryptocurrencies may increase. However, this does not mean that investing in them will always create a huge return.

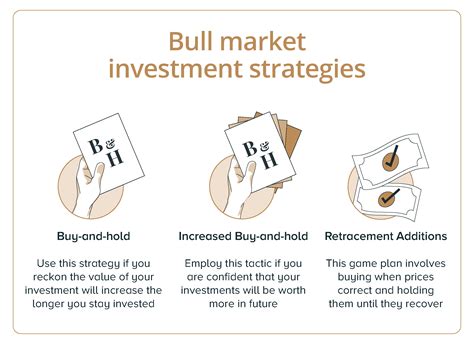

Bull Market Strategy for cryptocurrency investments

Here are some effective strategies to invest reasonably in cryptocurrency:

- Dollar Cost average (DCA)

One popular strategy is to invest a fixed amount of money at regular intervals, regardless of market conditions. This can help reduce the impact of price fluctuations and time risks associated with individual transactions.

To implement the DCA, create a repeat investment plan that regularly transfers a fixed amount of funds to your cryptocurrency account, such as a week or monthly. As prices increase during the bull market, over time you will benefit from the accumulated value.

- Value Investing

Another approach is to identify undervalued cryptocurrency and invest in lower prices. This strategy requires a wide range of market trends, basic principles and technical indicators.

In order to implement investment in value, to conduct a thorough study on each cryptocurrency, including its financial data, the chances of growth and potential risks. Determine those with strong core values and technical indicators and adopt a strategic investment decision accordingly.

- Risk Management

While investing in cryptocurrency growing can be highly volatile, it is important to maintain a stable risk management strategy. This includes determining clear investment goals, setting a stop-losing level and diversifying your portfolio in different asset classes.

Consider the following questions to implement effective risk management:

- Create real investment expectations and time view.

- Diverse your portfolio by investing in several cryptocurrencies and active.

- Maintain a balanced portfolio with both long -term and short -term participation.

- Be prepared to customize your strategy as market conditions change.

- Attract trade

Another popular approach is to use trading strategies, such as buying or selling spare to increase the benefits during the bull market.

Consider the following: to effectively implement the trade in attracted funds:

- Invest only a significant portion of your capital through borrowed transactions.

- Use suspension orders to limit possible losses.

- Close your position closely and adjust your strategy accordingly.

- Technical Analysis

In addition to fundamental analysis, technical analysis can also be used to identify trends and models within the growing cryptocurrency. By analyzing diagram models, indicators and other technical data, you can make more informed investment decisions.

To implement an effective technical analysis:

- Research market charts and technical indicators to understand trends and models.