Understanding the Risks of Trading in a Bear Market: A guide to cryptocurrency investing

The world of cryptocurrency has experienced significant growth and volatility over the years. . Trading Cryptocurrencies During a bear market and provide guidance on how to navigate these challenges.

What is a bear market?

. This During a bear market, the value of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others tends to decrease, make them less attractive to investors.

Risks of Trading in a Bear Market

Trading. Here are some key considerations:

- Market volatility : cryptocurrencies can experience rapid price swings, even during a bear market. This volatility can lead to significant losses if you don’t act quickly or make informed decisions.

- Liquidity Risk :

.

- This lack of regulation can lead to losses due to hacking, theft, or other Malicious activities.

*

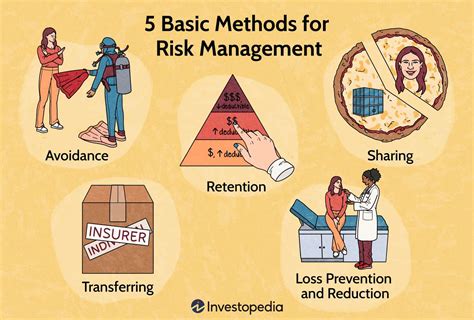

Mitigating Risks in a Bear Market

While trading

- Diversify your portfolio

:

- This will help you informed decisions about when to take on more risk or retreat.

.

- Consider using margin trading :

. However, be aware that emotional decisions made during a bear market

Best Practices for Trading in a Bear Market

Bear market effective, consider the following best practices:

1.

2.

3.